After years of focusing on relatively new and popular benefits, including student loan repayment programs or robust family leave or childcare benefits, a tried-and-true benefit is emerging as one of the best bets for attracting and keeping talent amid the Great Resignation: comprehensive health coverage.

That’s undoubtedly a result of the pandemic, which has taken more than 1 million American lives, infected or disabled many others, and led to delayed and missed diagnoses and treatment for other conditions—all of which ultimately is returning physical healthcare to the spotlight.

“There are many dark aspects of COVID. But one of the things that is actually a real positive is it has refocused the importance of healthcare and attending to it in very basic ways, but also in very deliberate ways. It’s enabled us to reimagine what should we be offering as healthcare,” says Cecilia McKenney, Quest Diagnostics senior vice president and chief human resources officer. “The most foundational care is the healthcare program that you offer your employees.”

That sentiment is a highlight of a new report by Quest Diagnostics—released first by HRE—which finds that HR executives and employees not only feel employee health is increasing in importance but is also a key way to keep and attract talent today. Employees are looking for more robust health coverage from their employer—including health screenings, comprehensive medical coverage, wellness programs, telehealth and more. Access and affordability are key as well.

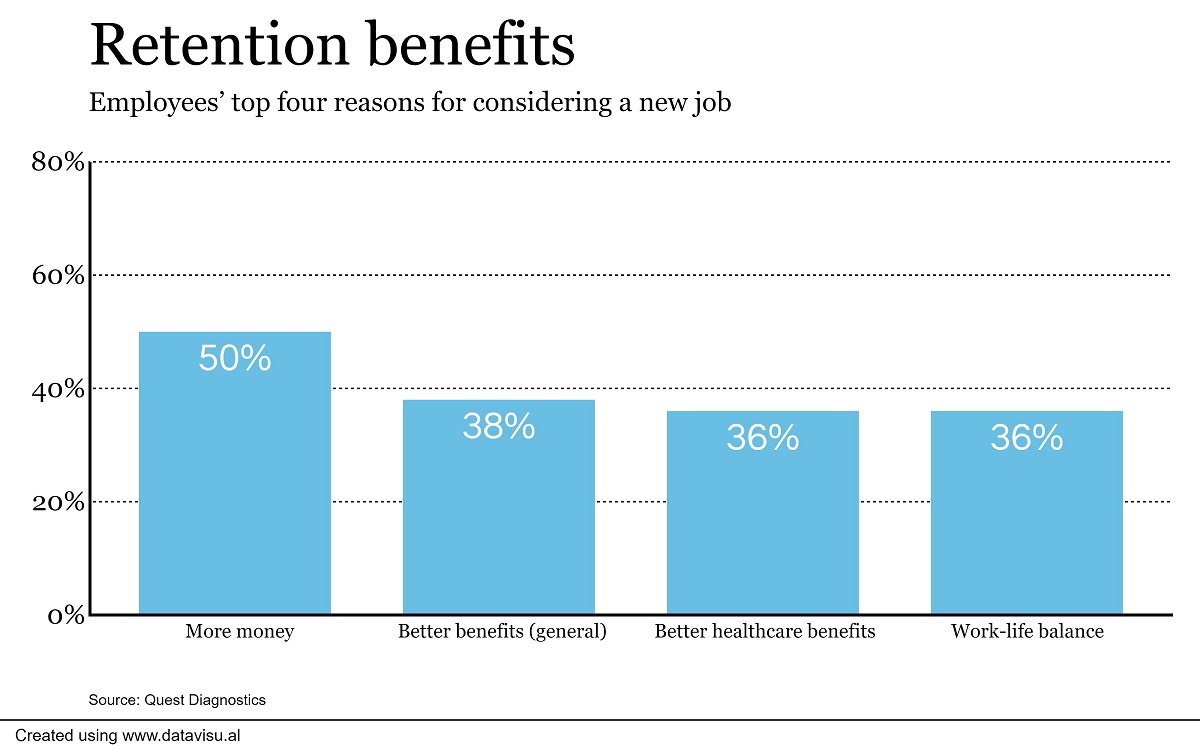

Among employees thinking about changing jobs, better benefits in general (38%), better healthcare benefits specifically (36%), and work/life balance (36%) were three of the top four reasons employees were considering the change. More money was the top reason, at 50%. The medical lab surveyed 423 HR and benefits executives and 846 employees at companies with 100 workers or more.

Among employees thinking about changing jobs, better benefits in general (38%), better healthcare benefits specifically (36%), and work/life balance (36%) were three of the top four reasons employees were considering the change. More money was the top reason, at 50%. The medical lab surveyed 423 HR and benefits executives and 846 employees at companies with 100 workers or more.

As millions of employees voluntarily leave their jobs—or plan to—often lured by higher pay and better benefits, McKenney warns that HR and benefits leaders cannot lose sight of what’s important for employees, like healthcare and work-life balance. A record 4.5 million workers quit their jobs in March.

“I’ve been in the business of CHRO for a long time, and it’s almost like we’ve begun to take healthcare for granted,” she tells HRE.

Related: From better benefits to higher pay, employers are upping the ante on talent

The renewed healthcare focus comes, too, as chronic conditions become a bigger concern. Throughout the worst of the pandemic, more than half (56%) of HR executives had to manage sick workers, implement safety policies and manage hybrid/remote work transitions, among other challenges. Now, the prospect that employees are hampered by other illnesses is a point of concern for HR and benefits executives. A whopping three-quarters (73%) express concern that their employees may be sick with chronic illnesses because they haven’t had wellness checks during the pandemic, according to the Quest survey.

The worries appear warranted: Three in five (63%) of employees say they put off routine medical appointments and/or screening over the past two years, and about three-quarters (77%) say preventive healthcare is hard to perform during the pandemic.

Early detection and treatment of many chronic illnesses, including cancer, diabetes and heart disease, are associated with improved health outcomes. So it’s not surprising that 90% of HR and benefits executives and 89% of employees surveyed say that health screening programs are essential for a company to be considered an employer of choice that attracts and keeps talent.

Early detection and treatment of many chronic illnesses, including cancer, diabetes and heart disease, are associated with improved health outcomes. So it’s not surprising that 90% of HR and benefits executives and 89% of employees surveyed say that health screening programs are essential for a company to be considered an employer of choice that attracts and keeps talent.

Not only is comprehensive coverage a must for retaining workers, but so is holding down healthcare costs. A number of factors—from pandemic-related deferred care and late diagnoses to health system consolidation, COVID-19 infections and long-haul COVID—are driving up healthcare costs. And inflation, which is driving up medical costs and a host of other costs for employees, isn’t helping either.

The Quest survey finds that 87% of HR and benefits executives and 89% of employees say health insurance is too expensive and that the pandemic’s effects on health will drive costs even higher. The majority of both groups also believe that companies should pay for most healthcare costs.

“With wages rising, employers can’t afford to support both [pay] increases and increases in healthcare, so controlling healthcare costs is very important,” McKenney says. “Employees want us to control healthcare costs and, frankly, help them to make better decisions on controlling costs.”

“With wages rising, employers can’t afford to support both [pay] increases and increases in healthcare, so controlling healthcare costs is very important,” McKenney says. “Employees want us to control healthcare costs and, frankly, help them to make better decisions on controlling costs.”

Related: 5 employer strategies to help with soaring inflation

Recent reports have indicated that healthcare costs are expected to surge. A Willis Towers Watson report last month found that nearly all U.S. employers (94%) say managing healthcare benefit costs will be their top priority over the next two years.

With all this in mind, McKenney says focusing on healthcare is an opportunity employers shouldn’t waste.

“[Medical coverage] has been the sleeping benefit, and it’s awakened in COVID,” she says. “And this is a huge new opportunity.”

The post Back to basics? The core benefit HR can no longer take for granted appeared first on HR Executive.