When Elaine Davis took over as chief human resources officer at Continuum Global Solutions last year, she immediately recognized the financial stress many of the customer care provider’s employees were under.

Many of the company’s workers are female and have a lot of childcare expenses. What’s more, she learned, some employees didn’t have a savings or checking account and didn’t know the basics of banking or how to deposit a paycheck.

And the pandemic—which forced employees to work from home while struggling to afford things like reliable internet or childcare to adequately do their jobs—made those financial stresses even higher.

Elaine Davis

“[A lot of workers] are finally strapped,” Davis says. “And on a biweekly pay schedule, our [employees] were going a long time between paychecks.”

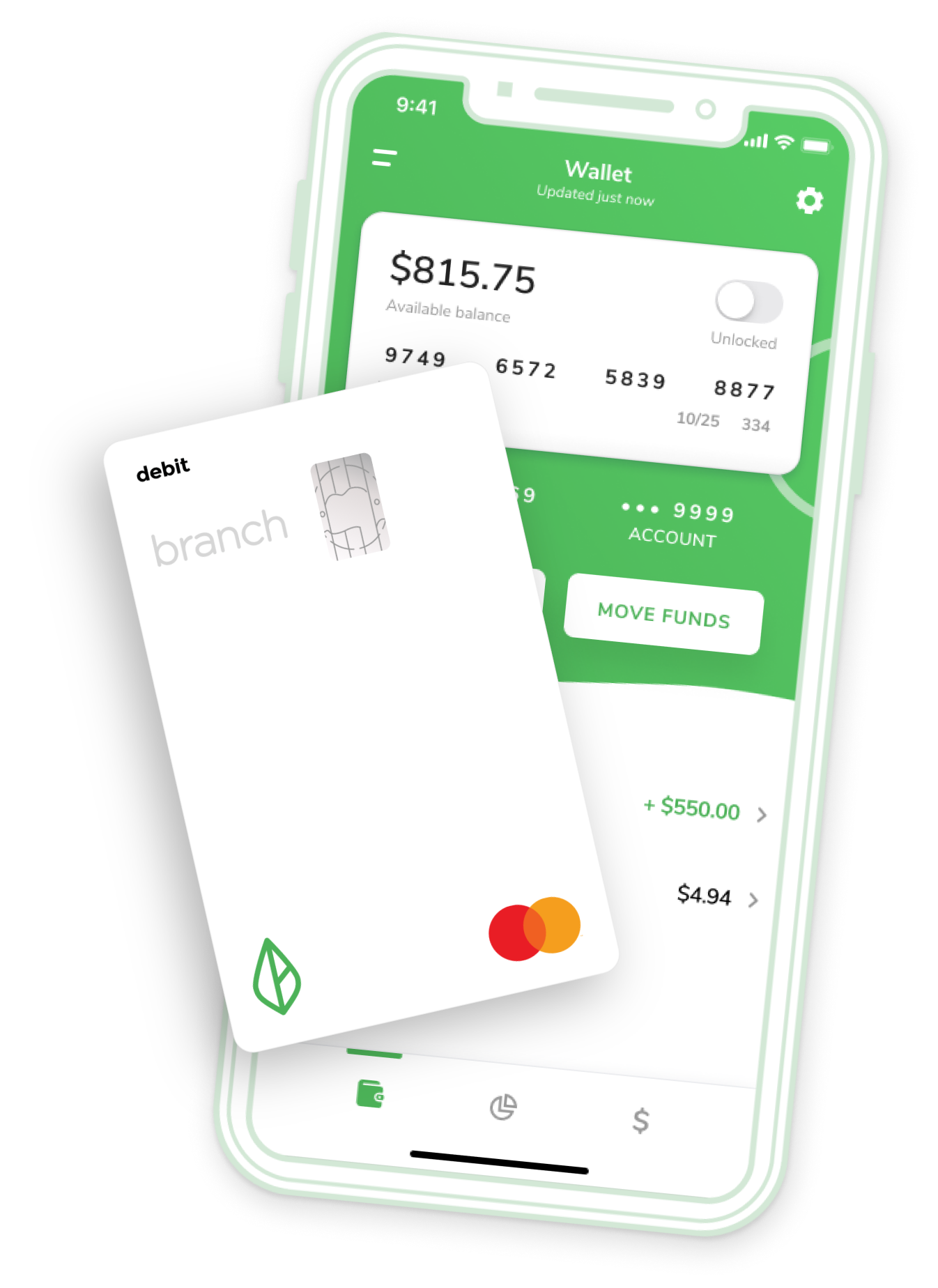

In response, Continuum in July rolled out access to Branch—an instant pay and financial wellness company that works with employers—to its entire U.S. population, about 7,000 employees. Through Branch, Continuum employees are able to access their pay in advance of payday—they can use the app to receive a portion of their earned wages right after each shift. Branch also aims to help employees eliminate fees and better meet their personal finance needs by providing a fee-free checking account, debit card and auto-budgeting tool.

“It puts money in the hands of my people when they want it,” Davis says. “It struck a great balance for me, giving people control of money when they needed it or wanted it without creating any undue burden for me or the company from either a processing perspective or a cash-flow perspective.”

More important than more regular access to pay is the financial education piece, Davis says, which aims to help employees learn to budget and better understand their money. One goal of the benefit is to help workers gain financial literacy and self-sufficiency, she says.

More important than more regular access to pay is the financial education piece, Davis says, which aims to help employees learn to budget and better understand their money. One goal of the benefit is to help workers gain financial literacy and self-sufficiency, she says.

Atif Siddiqi

“Even before the pandemic, the vast majority of workers were living paycheck to paycheck; people had little or nothing saved,” says Branch CEO Atif Siddiqi. “Post-pandemic, there are even more challenges for workers to establish financial stability; they might have seen a decrease in hours, maybe a household income has gone down—just more economic uncertainty in their lives.”

Eighty percent of hourly workers have less than $500 saved for an emergency, according to a survey of 3,000 hourly employees by Branch. What’s more, the percentage of hourly workers who have $0 saved increased 12% from last year to 52%.

Related: HRE’s number of the day: lack of employee savings

Siddiqi notes employers have a “social responsibility to really help employees during this time.”

Employee response to Continuum’s new benefit has been “fantastic,” Davis says. “They love it. They’re grateful for it. We didn’t want to see people becoming dependent on daily pay. But what we are seeing is people use it on an as-needed basis. They’re not overusing it.”

Tweet this storyClick To Tweet

To taper constant usage, Davis says, she offers regular communication pieces about daily pay—and encourages employees to take advantage of financial education.

Financial wellness and improving employees’ situation is top of mind for Continuum, Davis says. She says the company is working to get in a position where it can pay higher wages, more incentives and more bonuses.

“We want to share the wealth when we get that wealth,” she says. “In the meantime, being able to provide people access to the money they have earned earlier and providing them access to financial education and tools is a great step for me. I think it’s going to improve us as an employer—I think it will help us get people, and I think it’s going to help us keep people.”