Small businesses in California, Oregon and Washington have been recently reminded of the July 26 and July 28 deadlines for applying for SBA federal disaster loans for economic injury caused by wildfires last year.

Northwest Small Businesses Affected by Wildfires Face Important Deadline

Director Tanya N. Garfield of the U.S. Small Business Administration’s Disaster Field Operations Center-West said certain small businesses can apply for Economic Injury Disaster Loans of up to $2 million to help meet working capital needs caused by the disastrous fires. The eligible businesses include small non-farm businesses, small agricultural cooperatives, small businesses engaged in aquaculture, and most private non-profit organizations of any size.

Low-Interest Loan Deadline Approaches

The deadline means there is less than a month for such businesses to file their applications which can be a huge help in these trying times. Businesses in California and Washington have an earlier deadline of July 26, 2022, while businesses in Oregon have a deadline of July 28, 2022.

The interest rate is 2.88% for businesses and 2% for private non-profit organizations with terms up to 30 years. Final loan amounts and terms will be set by the SBA and will be based on each applicant’s financial condition.

Help for Businesses to Recover from Wildfires

Director Garfield said of the loans: “Economic Injury Disaster Loans may be used to pay fixed debts, payroll, accounts payable and other bills that cannot be paid because of the disaster’s impact. Economic injury assistance is available regardless of whether the applicant suffered any property damage.”

Applicants for the loans can apply online at the Disaster Loans website, as well as receive additional disaster assistance information or download applications. Completed applications should be mailed to U.S. Small Business Administration, Processing and Disbursement Center, 14925 Kingsport Road, Fort Worth, TX 76155.

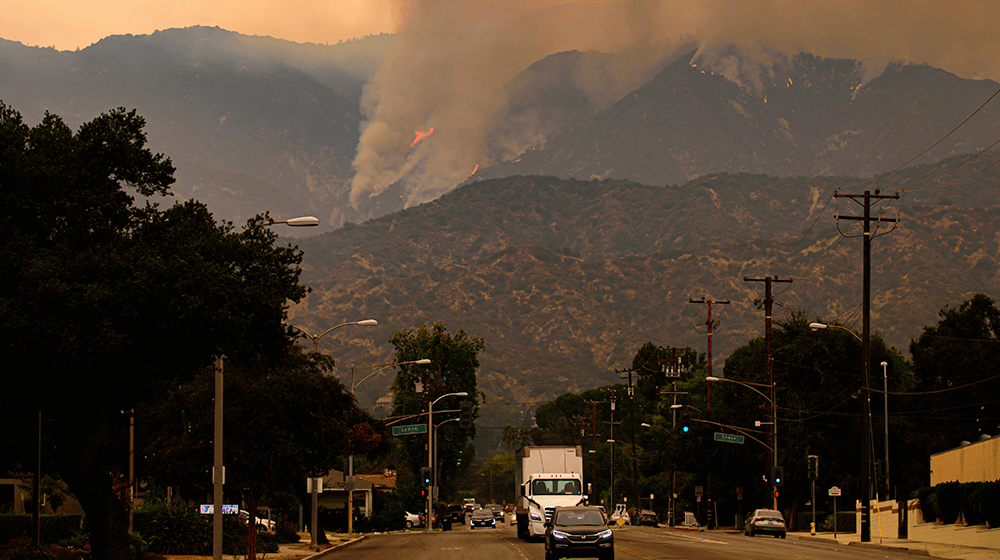

How Wildfires Devastated Local Businesses

The wildfires that led to these loans being made available occurred between July and September last year. The White Center Fire in King County, Washington, started on July 5, and the Seattle Times reported on the conditions business owners were faced with, saying: “The fires, plus ongoing window smashings and burglaries, have left White Center businesses devastated and in a ‘state of emergency,’ said Helen Shor-Wong, program manager for the White Center Community Development Association, at an Oct. 8 meeting between business owners and King County leaders.”

The Seattle Times also described how business owners were demanding more help from the county and elected officials, saying: “Ana Castro, co-owner of the longtime White Center stalwart Salvadorean Bakery and Restaurant, talked about paying $4,000 to have her plate glass window repaired after it was smashed, and her staff not feeling safe to come to work.

“But it’s not just the series of destructive events that are frustrating business owners, it’s what they say is the lack of response from county officials and other elected officials to their plight. At the meeting, business owners presented the county with a petition asking that they do more to help.”

The Hopkins Fire in Mendocino County, California, raged between September 12-20. The longest-running fire was the Bootleg Fire in Klamath County, Oregon, which took around five weeks to get under control between July 6 and August 15.

Image: Depositphotos

This article, “Northwest Small Businesses Affected by Wildfires Face Important Deadline” was first published on Small Business Trends