Congressional leaders have agreed to a roughly $900 billion economic relief packages that includes a second round of stimulus payments, pursuant to the “Emergency Coronavirus Relief Act of 2020.”

The second stimulus payment will be:

- A onetime stimulus payment of $600 for each individual

- A onetime stimulus payment of $1,200 for married or joint filers

- A onetime stimulus payment of $600 for certain dependents

In order to qualify for the second stimulus payment, you will need to have earned (in 2019) less than $75,000 (for individuals) or $150,000 (for married/joint filers). If your income is higher than those limits, then the stimulus payment is reduced by 5% of your adjusted gross income above those limits. This was the formula and income threshold under the first stimulus payment bill.

How can you make sure you get the second stimulus payment quickly if you do qualify? The key is for the IRS to have direct deposit account information for your bank account. Otherwise the payment will be sent by mail and could be delayed significantly.

How to get your stimulus payment direct deposited

Depending on your situation, here is what you need to do to get your stimulus payment direct deposited to your bank account:

1. If you have already filed your 2019 tax return with the correct deposit information

If you have already filed your 2019 tax return with the IRS with your correct direct deposit information, you don’t need to do anything more.

2. If you haven’t yet filed your 2018 or 2019 tax return

If you haven’t filed your 2018 or 2019 tax return with the IRS, you need to file either one electronically with the IRS (unless you are exempt as a Social Security benefits recipient as discussed below). There are some free websites that allow you to file your return electronically. See the sites recommended by the IRS at www.irs.gov/filing/free-file-do-your-federal-taxes-for-free. Make sure to include your direct deposit information in this filing (where it asks if you want any refund sent by direct deposit).

3. If you are not required to file income tax returns for 2018 or 2019

You are not required to file federal income tax returns for 2018 and 2019 if:

- Your income is less than $12,200.

- You’re married and filing jointly, and together your income is less than $24,400.

- You have no income.

If you are not required to file a federal income tax return, then you will probably have to wait for the IRS to open up the “Non-Filers: Enter Payments Info Here” tool to submit the information to get your second stimulus payment. (You cannot use this tool if you can be claimed as a dependent on someone else’s tax return.)

The information you will need to provide includes:

- Full name, current mailing address, and an email address

- Date of birth and valid Social Security number

- Bank account number, type, and routing number if you have one

- Identity Protection Personal Identification Number (IP PIN) you received from the IRS earlier this year if you have one. Taxpayers who previously have been issued an Identity Protection PIN but lost it must use the “Get an IP PIN” tool to retrieve their numbers

- Driver’s license or state-issued ID if you have one

- For each qualifying child during 2019: name, Social Security number or Adoption Taxpayer Identification Number, and their relationship to you or your spouse

4. If you are a Social Security recipient

The Treasury previously announced that if you are a Social Security recipient who typically is not required to file a tax return, you will automatically receive your stimulus payment directly to your bank account without having to file a tax return as long as the IRS has your direct deposit information.

5. If the bank account you put on your tax return is no longer active

If the bank account direct deposit information you provided in your last tax return is no longer active, the IRS will mail your payment to the last address it has on file for you.

The “Get My Payment” IRS tool and how to provide current bank information

The Treasury has created an online tool (“Get My Payment”) where direct deposit information can be supplied to the IRS. Here is what you should do:

- On April 15, 2020, the IRS set up an online tool that allows you to track the status of your stimulus payment, and it allows you to provide your direct deposit information. (To learn more, read IRS Launches Online Tool to Track the Status of Your Stimulus Payment and Have It Direct Deposited.)

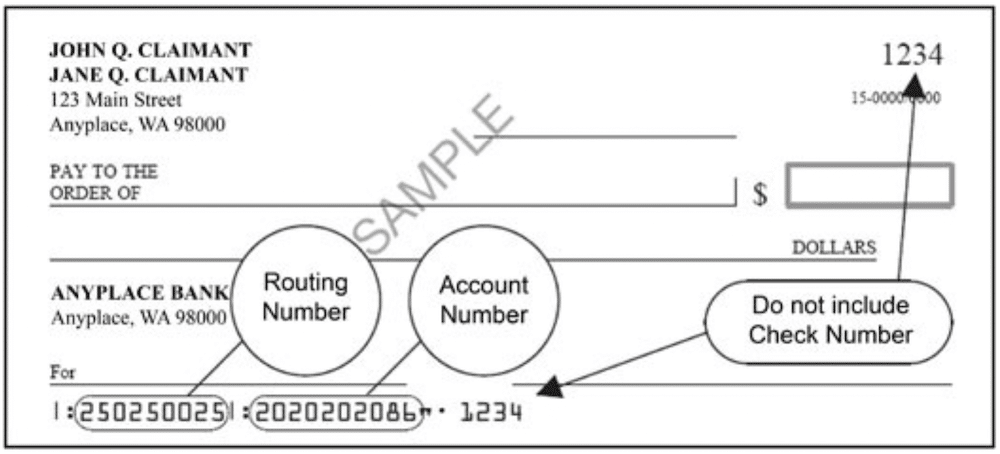

- Add the bank account number of your account.

- Add the routing number of your bank.

- Do not include a check number.

- Double-check that you have entered the correct numbers; entering an incorrect number could result in a significant delay of payment.

You can use the “Get My Payment” tool to find out the projected date for when your deposit is scheduled to arrive in your bank account. The “Get My Payment” tool will also tell you if you’re set to receive payment by paper check, along with a scheduled arrival date in the mail.

The tool, however, doesn’t always work, and your inquiry may result in a “Payment Status Not Available” message.

While “Get My Payment” allows you to give direct deposit information to the IRS, you cannot change bank information with the IRS if it already has an account for you on file. This is to help protect against potential fraud. You also can’t change your form of payment if the IRS has already scheduled it for delivery.

How to set up direct deposit

To set up direct deposit, provide the following information:

- The name of your bank

- Your bank account number, which can be up to 17 characters (see image below). On the sample check below, the account number is 2020202086.

- The “routing number” for your bank, which must contain 9 digits (see image below). On the sample check below, the routing number is 250250025.

- Do not include the check number (1234 on the image below).

Will you have to pay any income tax on the second stimulus payment?

You will not have to pay income tax on the amount of payment received.

Avoid scams targeting your stimulus payment

Criminals this year have turned their attention to stealing stimulus payments. Much of this stems from identity theft, whereby criminals file false tax returns or supply other bogus information to the IRS to divert refunds to alternate addresses or bank accounts.

Be sure to read Coronavirus stimulus payment scams: What you need to know, in which the FTC outlines to following four key points to help you avoid a scam:

- Only use irs.gov/coronavirus to submit information to the IRS—and never respond directly to a call, text, or email.

- The IRS won’t contact you by phone, email, text message, or on social media with information about your stimulus payment, or to ask you for your Social Security number, bank account, or government benefits debit card account number. Anyone who does is a scammer phishing for your information.

- You don’t have to pay to get your stimulus money.

- The IRS won’t tell you to deposit your stimulus check and send them money back because they paid you more than they owed you. That’s a fake check scam.

Report scams to the Federal Trade Commission at ftc.gov/complaint.

Related: How to Protect Yourself from the “Dirty Dozen” Tax Scams and Financial Help for Freelancers and Independent Contractors Affected by the Coronavirus Crisis

What IRS resources are available for more information?

Check these links for updated information:

- www.irs.gov

- www.irs.gov/newsroom/economic-impact-payments-what-you-need-to-know

- www.irs.gov/coronavirus

- www.irs.gov/coronavirus/get-my-payment-frequently-asked-questions

Copyright © by Richard D. Harroch. All Rights Reserved

The post How to Get Your Second Stimulus Payment Direct Deposited to Your Bank Account appeared first on AllBusiness.com. Click for more information about Richard Harroch. Copyright 2020 by AllBusiness.com. All rights reserved. The content and images contained in this RSS feed may only be used through an RSS reader and may not be reproduced on another website without the express written permission of the owner of AllBusiness.com.