The deadline to apply for a Paycheck Protection Program (PPP) loan is fast approaching.

The program officially runs out on June 30, 2020. At last count, about $120 billion in PPP funding remains.

Through Monday afternoon, the Small Business Administration says the PPP loan program has approved more than 4.6 million loans nationwide. Companies borrowed more than $515 billion dollars. And the average loan size is about $110,187. There are more than 5,400 lenders participating in PPP.

PPP Loan Deadline is June 30

You still have time to apply and secure funding. But don’t wait until the last minute.

Apply as soon as possible. In order to allow sufficient loan application processing time, lenders are imposing their own earlier cut-off dates.

The PPP program provides low interest loans to small businesses with up to 500 employees, as well as to self-employed entrepreneurs. Business owners and entrepreneurs who receive loans can later apply to have some or all of the loan forgiven by the Small Business Adminstration, if they meet the Program criteria.

The SBA says loans are fully forgiven if any businesses getting money spends it on:

- Payroll – 60% of money forgiven must be spent on payroll

- Mortgage interest

- Rent

- Utilities

The Program underwent simplification with the recent passage of the Paycheck Protection Program Flexibility Act on June 5, 2020. The Flexibility Act made several key changes in the program. The changes overall make it easier for small businesses and self-employed individuals to comply with the Program requirements and obtain forgiveness of the loan. Important changes to the Paycheck Protection Program include:

- 24 weeks to spend the loan money, up from 8

- More lenders available

- Loans after June 5 have a maturity of 5 years, not 2 years like loans before June 5

Apply Quickly for a PPP Loan

Despite the clock ticking on applying for a PPP Loan, it’s really not too late. And the SBA just re-launched its Lender Match online tool to help you find a bank or other institution or company that can give you the loan.

SBA Lender Match Tool

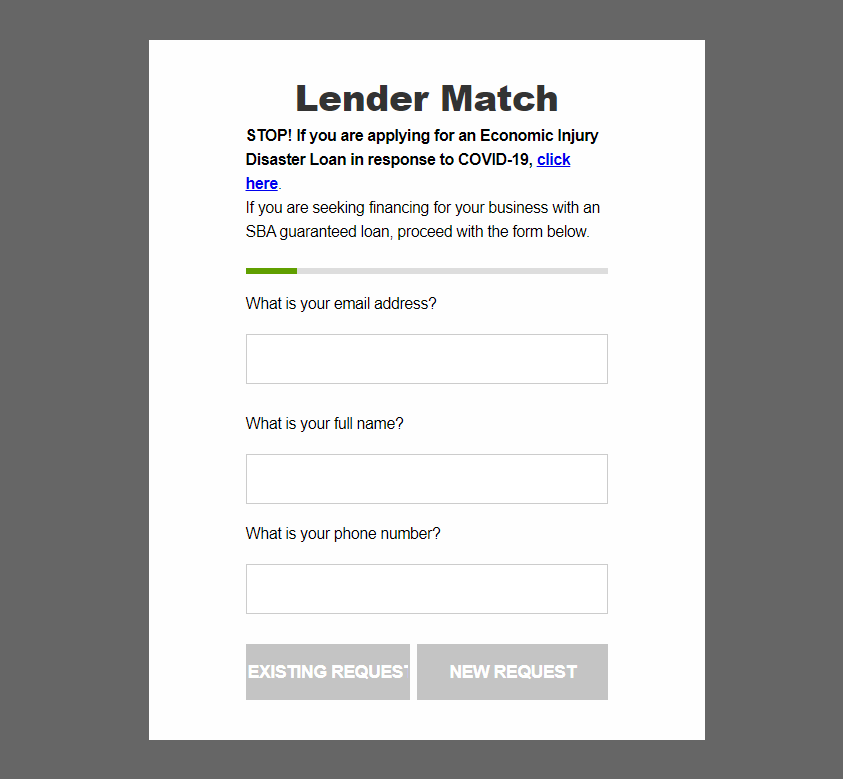

The SBA Lender Match tool works fairly simply. Just type in your information and the SBA works to connect you with lenders in 48 hours.

You can then compare your offers, if you get more than one, and then finally apply for that loan. This can be done relatively quickly. And if you don’t dawdle, you’ll hear back on your loan before the June 30 deadline.

This is the first screen you’ll see once you begin the Lender Match process:

Before you go rushing into the loan application process, the SBA does recommend having several things ready if, and more likely, when would-be lenders ask:

- Business plan

- Spending plan for loan money

- Credit history

- Financial projections

- Industry experience

The SBA says collateral and personal guarantees are not required to receive PPP loan funds.

Apply for Several PPP Loans

Even if you applied at one lender, you can apply at others if your lender is taking a long time. There’s no restriction on applying with multiple lenders. The SBA’s processes should prevent approval of more than one loan.

Keep in mind, you can only accept funding from one PPP loan. But by applying at multiple lenders you may increase the likelihood of getting a PPP loan before the program expires.

Contact your bank or credit union today to apply. You must apply with an approved PPP lender — do not apply directly with the SBA.

You can apply for PPP loans at online sites like PayPal, and Kabbage, as well as through Kabbage. Or find a lender near you through the SBA website’s map locator.

Images: SBA.gov

This article, “PPP Loan Deadline in June 30 – Still Time to Apply” was first published on Small Business Trends