As a small business owner, there’s an abundance of tax forms you need to familiarize yourself with – and one of them is the W2 form.

The IRS requires every employer to submit this form for their employees. However, this form may not apply to all those who work for your company.

Employees working for your business – whether part-time or full-time – under an employment agreement are W2 employees. Your business will be responsible for providing employee benefits, work-related supplies, as well as paying taxes on their wages.

If independent contractors are working for you, note that they do not require a W2 form. These freelancers and contractors will have to file for their taxes themselves and with a different tax form.

With the distinction now made clear, it’s time to delve deeper and learn the intricacies of a W2 form.

What is a W2 Form?

A W2 form – also known as the Wage and Tax Statement – is the document used to report the amount of taxes withheld from an employee’s paycheck and the annual wages.

The IRS also refers to the W2 form as an informational return because it provides information to several vital parties, including:

- The employee’s state or city government

- The federal government

- The employee

While the data included is mainly about the employee’s earnings and tax payments, you should be the one to fill out the form as the employer.

How to Fill Out a W2 Form

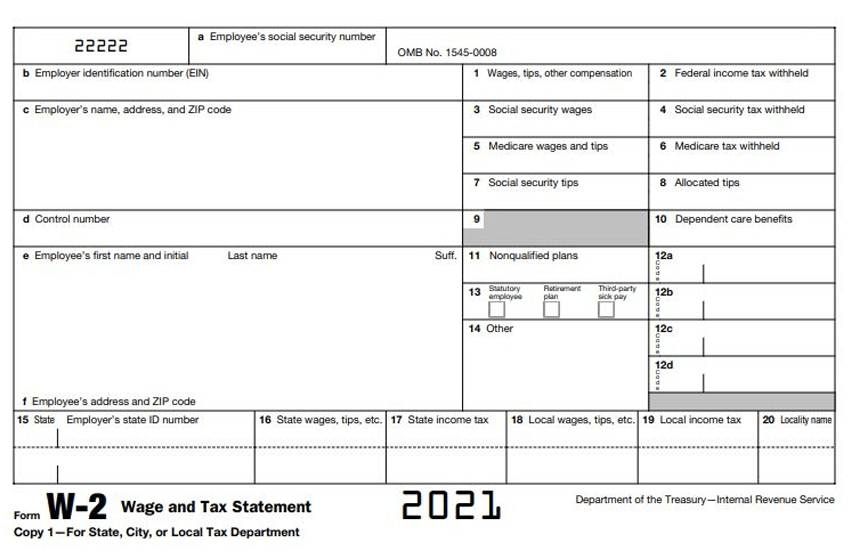

Learning how to read a W2 form can help you fill it out faster. Let’s start with the boxes on the left side of the document.

Box A is for your employee’s SSN, while B through D should contain your information. Here you’ll have to add your Employer Identification Number (EIN), your legal address, and the control number used by your payroll department. Finally, on Box E and F, you’ll have to fill in your employee’s legal name and address.

Here’s a more detailed look at what should go in the boxes on the right side of the form:

- Boxes 1 and 2: Box 1 should contain the total taxable wages and other compensation your employee received for the year. Box 2 is for the total amount of tax you withheld from the employee for the entire year.

- Boxes 3 and 4: These boxes show the gross wages taxed for Social security and the Social Security taxes withheld from your employee’s pay.

- Boxes 5 and 6: These boxes indicate all the taxed wages and tips and the amount withheld for Medicare.

- Boxes 7 and 8: Here, you’ll need to add the tips your employee reported to you and the tips you gave them.

- Box 9: This box is obsolete and should remain blank.

- Box 10: It should contain the total amount deducted for a dependent care assistance program.

- Box 11: Shows the amount your employee received for non-qualified deferred compensation plans.

- Box 12: This box reports several different types of compensation like the 401(k) plan. Details of the codes used are from the IRS W2 instructions.

- Box 13: You should check applicable boxes that refer to your employee, such as receiving sick pay from an insurance policy.

- Box 14: This box allows you to report anything that doesn’t fit into a specific box in the form.

- Boxes 15 to 20: These boxes refer to state and local taxes, including the total withheld from the employee’s earnings and the amount subject to these taxes.

How to Submit a W2 Form

Every year, you need to submit W2 forms to two different addresses – your employees’ residence and the Social Security Administration (SSA).

You can submit the W2 forms to SSA either by mail or online, as long as it’s before the deadline for submission – which is January 31 every year.

For mail submission, you must also include a W3 Transmittal Form summarizing all the information in the W2 forms. Submitting the forms online through SSA’s Business Services Online is faster and easier as it will automatically generate the W3 Form.

What are the Variants of W2 Form?

A W2 form can have two variants, traditional and condensed. The traditional form will have two copies of W2 on the top and bottom of the document. You’ll have to fill it out for two different employees, separate, and collate it for mailing. This variant follows the IRS/SSA standard.

Condensed W2 Forms, on the other hand, combine different W2 copies for the same employee on a single page.

Frequently Asked Questions

What is the difference between W2 and W4?

One of the main differences between these two forms is that the employer fills out W2 while the employee does the W4. Remember that the law prohibits you from filling out W4. Employees need to complete the W4 form themselves when you first hire them.

Is there a W2 for unemployment?

The state government sends a different form, Form 1099-G, for people who are under unemployment compensations. W2 is for wage income from business employers only.

Can employees get a copy of their W2 online?

Your employees can get an online copy of their W2 using TurboTax or H&R Block’s services. These online tax preparation companies offer a free W2 search and import function.

What if your employee loses the W2 form?

You can create a new form and send it to them, or your employee can ask for assistance from their local IRS Taxpayer Assistance Center (TAC). The IRS can help provide them estimates of their wages and federal income tax withheld.

Fulfill W2 Form Requirements for your Employees

Filling out and submitting W2 forms for employees is essential for any business. The IRS requires it, and failure to submit them on or before the deadline can lead to penalties. Complete this requirement with ease by following the information you learned here.

Image: Depositphotos

This article, “W2 Form Basics for Small Business Owners” was first published on Small Business Trends