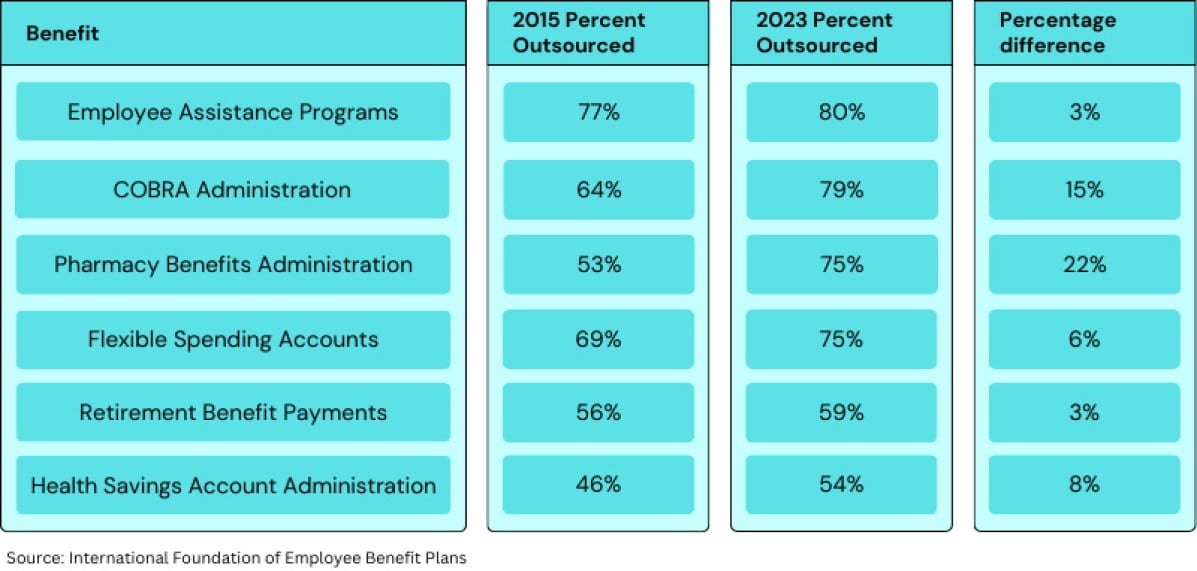

Since 2015, the number of employers that outsource the administration of COBRA and pharmacy benefits jumped by double digits, according to a recent report by the International Foundation of Employee Benefit Plans, which surveyed 231 U.S. employers of various sizes.

Overall, employers surveyed outsource 40% of their benefits functions—a decline of 4 percentage points in the last eight years—yet 79% outsource COBRA administration, compared to 64% in 2015. The increase for outsourcing pharmacy benefits administration was even greater, soaring 22 percentage points to about three-quarters of employers in the same period. The survey also found small increases in outsourcing trends for the administration of such benefits as HSA, FSAs, retirement benefits and employee assistance programs.

These increases come despite the fact that employers grew their benefits staff by more than 38% in the past five years, according to the report.

Clearly, employers aren’t using the additional benefits staff to bring more of the outsourced benefit functions in-house. So, what are employers doing with their larger teams?

Julie Stich, vice president of content at the International Foundation of Employee Benefit Plans, says the isolated outsourcing increases make sense given the complexities facing today’s benefits professionals.

Video

What’s driving outsourcing of COBRA administration?

Why is COBRA administration so likely to be outsourced?

For one, COBRA benefits may only tapped by a small number of employees—yet can be complicated to manage, Stich says. Employers, for example, need to track the period of time that someone is no longer with the company, as well as ensure the team is sending COBRA notices in a timely fashion. Additionally, given the changing regulatory environment, COBRA administration may require specialized expertise and guidance.

And, given the explosion of digital health solutions during the pandemic, Stich says, by outsourcing COBRA administration, HR leaders can guard against pervasive point-solution fatigue.

Related: Why outsourcing your leave program isn’t quite what you think

Pharmacy administration outsourcing grows as drug costs soar

With rising prescription costs among employers’ biggest concerns, organizations are seeking ways to contain expenses. This has led many employers to pharmacy benefit management companies (PBMs) or administration firms, Stich says.

However, employers and Congress are increasingly getting dismayed with PBMs, citing the complex, confusing methodology that middlemen PBMs use to set drug prices for employers. These prices are based on the rebates PBMs receive from drug manufacturers for the prescriptions purchased on behalf of employers.

Congress is calling for reforms to increase transparency in PBMs’ pricing process. Employers are also seeking more solutions. Some self-insured organizations, for example, may be kicking the tires on the Mark Cuban CostPlus Drug Company, which recently expanded to serve employers, according to a Forbes report. The company, according to the report, provides a simple pricing structure that charges 15% above the cost of the drug and potentially a nominal pharmacy fee.

Looking ahead, Stich says, the Congressional controversy over PBMs could impact employers’ likelihood to continue outsourcing pharmacy benefits administration.

“I think employers will be watching that [Congressional challenge to PBMs] to see what happens,” she says. “They’ll be talking to their broader healthcare providers and other benefit consultants to see what makes sense.”

The post Benefits outsourcing is declining—except in these two areas appeared first on HR Executive.