Kabbage has announced the launch of its new checking account solution targeting small businesses. The new offering provides small businesses access to digital banking services including electronic wallets, free ATM access and bill payments.

According to Kabbage, these are the same capabilities, convenience and security businesses can expect with a traditional checking account. This offering comes without monthly fees. And it offers a 1.10% Annual Percentage Yield (APY) – touted as one of the highest rates in the industry.

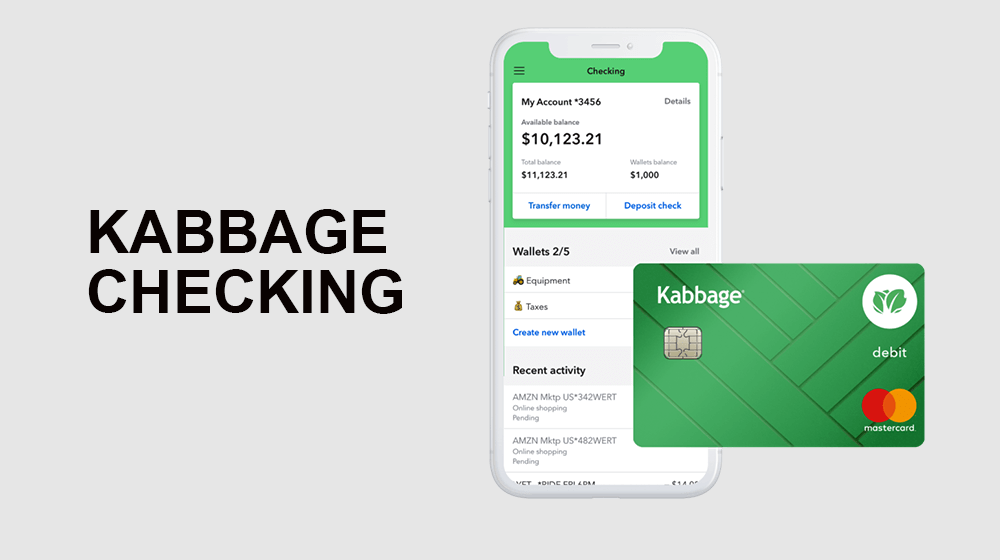

Kabbage Checking

Interested businesses can apply for a Kabbage Checking account irrespective of their prior relationship with Kabbage. Furthermore, there are no opening fees or maintenance fees required.

“Kabbage Checking is a new banking service built to give those small businesses an upper hand to earn more, save more and grow their business faster without sacrificing anything they expect from a bank,” said Kabbage President Kathryn Petralia.

Applying for a checking account according to Kabbage takes less than 10 minutes. All you need is just basic information about you and your business.

Kabbage checking accounts will be issued by its partner bank Green Dot Bank. Kabbage also allows businesses to connect other business services such as Intuit QuickBooks, eBay, Amazon and PayPal.

A Snapshot of the Services

Kabbage’s checking account is insured by the Federal Deposit Insurance Corporation (FDIC) and it is insured up to $250,000. Within an account, businesses have the option of opening up to five wallet sub-accounts to help them manage several income streams and track savings.

You can make deposits to the checking account at one of Kabbage’s 90,000 participating retailers and service centers nationwide. Kabbage Debit Mastercard will allow you to withdraw cash through a network of free ATMs. You can also start using your virtual card number as soon as you open your account. This allows you to make online purchases while you wait for your card to arrive.

Customers of the checking accounting service have the option to also use other Kabbage products. This includes Kabbage Insights, Kabbage Payments and Kabbage Funding to access cash flow analyses and forecasts, make payments and stop accounts from going negative.

The company notes this will strengthen its existing set of complementary solutions, which when combined gives businesses an immediate technology advantage historically reserved and difficult to attain even for big companies. The result, the company says, will give small businesses access to unified cash flow tools in minutes with zero upfront costs or commitments.

Kabbage Checking is also set to start supporting wire transfers and mobile remote deposits. These services will be rolled out throughout the year.

Why Cash Flow is Important

Cash flow management is an important aspect of every business. Healthy cash flow means a business can pay salaries on time and also have funds for growth and expansion. It also makes sure there is money to keep the lights on and taxes are paid on time. Cash flow helps you determine how much cash is generated and spent by your business in a given period of time. Simply put, it gives you a picture of the amount of money coming in and getting out of your business through expenses.

A good cash flow analysis will give you insights into three very important aspects of your business: operations, investments and financing.

In investments, it shows you the net income you are generating from your core business activities. Positive income from investment comes by way of sales while negative cash flow comes from salaries, rent, taxes and others.

At the investment level, it refers to the amount of money tied up in equipment, property or manufacturing plants. If the upkeep of these exceeds their revenues then you are experiencing a negative cash flow.

The third factor is that of financing which is the amount of cash you are paying out to services loans or debts. Negative cash flow here does not necessarily mean you are losing money but paying down debt.

Regular analysis of cash flow is important to ensure things in your business are running smoothly. A cash flow analysis is a sure way of gauging the health of your business as it helps you pinpoint what is happening where.

Image: Kabbage.com

This article, “Kabbage Checking Gives Small Businesses Flexibility With Full Features” was first published on Small Business Trends