Everything, good or bad, during the global pandemic, seems surreal. Global HR technology investment is no exception.

Before the pandemic hit, 2019 was the biggest year we had ever seen for global HR tech VC investment, closing the year at $5.3 billion. That performance came on the heels of a record-setting 2018 at $4 billion. The trajectory from $4 billion to $5 billion was happening during “normal times,” and it made sense. Digital transformation was burgeoning worldwide, and HR leaders and technologists were innovating the future of work to keep up. Entrepreneurs and investors were keeping up with that demand.

Author George LaRocque

2020 brought the pandemic and all of the uncertainty that came with it. As COVID-19 shut down the global economy, it seemed pragmatic to expect the upward trajectory of global HR technology investment to reverse. It didn’t. It plateaued. 2020 saw another $5 billion invested globally in HR technology. Investors tapped their brakes during mid-2020 and then came roaring back in Q4. While 2020 wasn’t a record year, it was a continuance of a rapid pace of investment that had even the most seasoned analysts and industry operators shaking our heads in disbelief.

Then came 2021. The year-to-date total is climbing past $17.5 billion as I write this column. We tracked more than $6 billion in Q3 alone. Q2 at $4.9 billion looked more like the entire year of 2019 or 2020.

But why? It was the perfect storm.

Pent-up demand. Remember that the HR technology market had set records in 2018 and 2019, and the trajectory that plateaued in 2020 might have represented some pent-up demand.

Money is cheap. Mercer analyzed 2021 and said that “dry powder meets low-interest rates.” There is a lot of investment money looking for a place to go right now. Capital comes from investors as small as independent angels, the largest and notable VCs globally, and everything in between.

COVID and societal issues shed light on the need for new HR capabilities. The COVID pandemic accelerated innovation in hybrid and remote work, employee wellness, new learning models, upskilling and reskilling the workforce, and other issues. At the same time, societal issues like the increased racial tensions after the murder of George Floyd, the escalating #metoo movement, and further societal unrest accelerated issues like diversity, equity, inclusion, company culture, purpose, ESG initiatives, and more. Innovation and new ways of thinking are needed, and HR, tech entrepreneurs, and investors are stepping up.

COVID didn’t create these HR trends. While the resulting tech trends are accelerated, they are anything but temporary. All existed pre-COVID. The acceleration has been a more rapid move up an existing adoption curve. While we haven’t dealt with managing work through, or returning from, a pandemic before, these aren’t fads that will fade. Investors probably see sustainability in that.

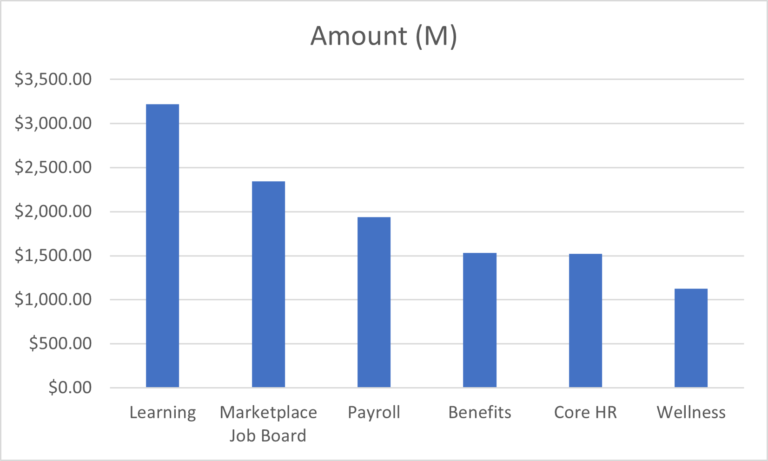

We tracked HR tech investment across 37 categories so far in 2021. These categories span the employee experience from pre-hire to exit. The top categories align with the challenges and trends we see in the enterprise today:

Learning

Learning has aggressively and consistently transformed for the last 10 years. The Chief Learning Officer (CLO) is in the hot seat. Fast-changing tech and consumerized user demands have been a challenge for the CLO to keep up with, to put it mildly. The pandemic and the C-suite’s focus on the need to upskill and reskill has exacerbated this. Learning is creeping into every facet of the employee experience, with some of the most interesting new models finding homes in talent acquisition. Some interesting emerging learning tech providers funded in 2021: 360Learning ($200M), Degreed ($153M), Codeboxx ($2M), Sirius Education ($1M).

Learning has aggressively and consistently transformed for the last 10 years. The Chief Learning Officer (CLO) is in the hot seat. Fast-changing tech and consumerized user demands have been a challenge for the CLO to keep up with, to put it mildly. The pandemic and the C-suite’s focus on the need to upskill and reskill has exacerbated this. Learning is creeping into every facet of the employee experience, with some of the most interesting new models finding homes in talent acquisition. Some interesting emerging learning tech providers funded in 2021: 360Learning ($200M), Degreed ($153M), Codeboxx ($2M), Sirius Education ($1M).

Marketplace job boards

Some are surprised to hear that the marketplace job board category is consistently the leader in dollars invested by a large margin. Entrepreneurs and investors love two-sided marketplaces. More importantly, marketplace job boards are the closest thing to consumer tech in the space. Marketplace job boards have led the market in industry and job-type specialization. They’re usually the first to focus on new work models (e.g., freelance/gig/contingent). And, they are looked to first to expand recruiting reach and deliver more diverse candidate pools. Let’s not forget the adoption of new techs like AI and matching, and now the rush to reskill the workforce at large. Some interesting emerging marketplace job boards funded in 2021: jobandtalent ($718M), Andela ($200M), Mom Project ($80M), Multiverse ($44M).

Benefits and the closely aligned subcategory of payroll have seen incredible innovation and growth capital to support them this year. Both statutory and elective benefits have caught considerable attention. Mental wellbeing as a benefit garnered enormous interest from corporates, investors and tech providers. In payroll, innovations abound in global payroll data management, PEO as a platform, API as a product, on-demand pay, and more. Payroll is cool again. Some interesting emerging payroll and benefits providers funded in 2021: Remote ($150M), Oyster ($70M), Lyra Health ($380M), Sorbet ($21M).

*

I’ll be back in January with the final numbers for 2021 and a look at some of the more interesting emerging HR tech products across all categories and aligned with the trends we see HR leaders earmarking budgets for.