Small businesses often hire freelancers from overseas countries to cut operating costs. If you also do the same, then the latest news from Paysafe can delight both you and overseas freelancers who you hire.

Recently, Paysafe announced the U.S. launch of its Skrill Money Transfer service. The service will enable new and existing Skrill customers in the US to transfer money, without any transaction fee, to Mexico, India, and 16 other Asian and European countries. What’s more, Skrill will not charge recipients any fee to receive funds.

Skrill Money Transfer Now Available in the US

Small businesses, which often run on limited operating budgets, try to find ways to cut expenses. This is the reason why many small business owners work as solopreneurs, delegating tasks to overseas freelancers to save money.

In fact, 70% of small businesses have hired a freelancer in the past and 81% of small businesses plan to hire freelancers in the future, reports a LinkedIn survey.

Skrill Free Money Transfer Service enables small business owners to send payment to their overseas freelancers located in 18 countries without any transaction fee.

What’s more, Skrill also allows recipients to receive funds without any fee. So overseas freelancers from these countries will also save more money. In a nutshell, Skrill Free Money Transfer service is a win-win for both businesses and freelancers in those 18 countries.

Also, Skrill Free Money Transfer will help people in the US, who send money overseas to their friends and family members.

Lorenzo Pellegrino, CEO of Skrill, NETELLER, and Income Access at Paysafe, said in a prepared statement, “There has never been a more important time for remittance services, and we’re proud to bring Skrill Money Transfer to U.S. consumers, who send more money overseas to friends and family than anyone else in the world. New Americans and ex-pats with connections overseas will now be able to send their loved ones much-needed help. Together we’re always stronger.”

How to Start Using Skrill Free Money Transfer

To start using Skrill Money Transfer Service, you need to create a Skrill account that is free. And then, you can start paying your freelancers.

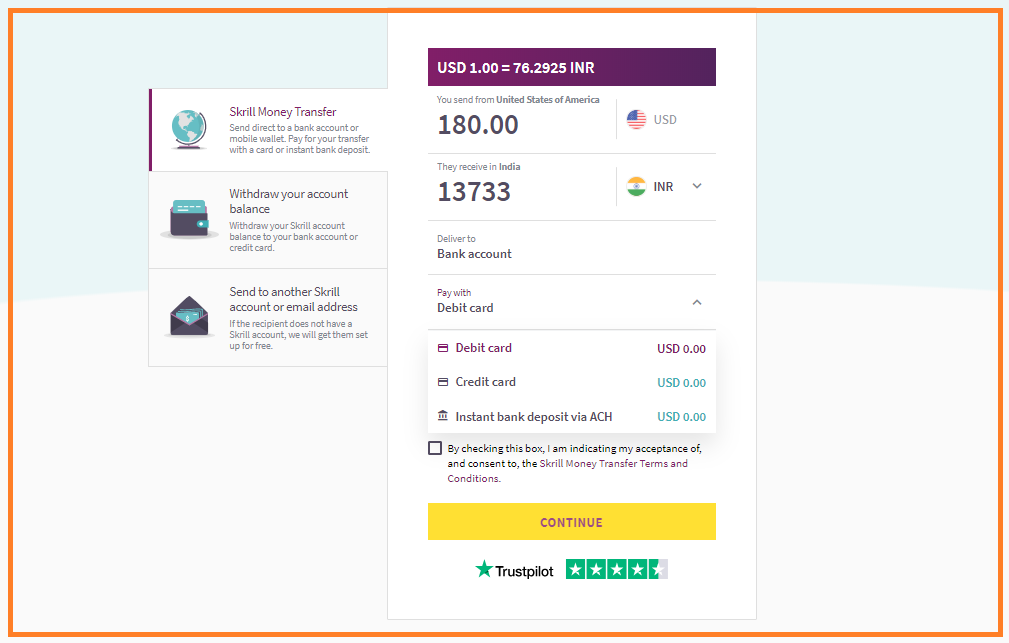

A good thing is you have multiple options to pay. You can use your debit card, credit card, or personal bank account (via ACH) to fund transfers from your Skrill account.

You can transfer money directly to bank accounts overseas, and recipients will not be charged a fee by Skrill to get funds. However, financial institutions of the recipients may charge any fee to receive or withdraw funds.

It is easy, quick to create a Skrill Wallet, and you currently have 40 currency to choose from.

About Paysafe and Skrill

Paysafe has been helping businesses and customers connect and transact seamlessly through its state-of-the-art capabilities in digital wallet, payment processing, card issuing, and online cash solutions for over 20 years. It employs approximately 3,000 employees located in 12+ global locations.

Skrill, powered by Paysafe, is a world leader in providing businesses and customers with global payment solutions.

If you want to know more about Skrill’s free international money transfer service in the US, you can click here.

READ MORE:

Image: Depositphotos.com

This article, “Paysafe Introduces Skrill Money Transfer for Zero-Fee Transactions to 18 Countries from the US” was first published on Small Business Trends